Information about Missouri Tax Filings

Form W2 for the State of Missouri

The State of Missouri requires the filing of Form W2. Form W2 provides an annual statement that includes gross wages, social security wages, tips, medicare wages, tax withholdings, and other compensation of employees from a business.

Note:You must file the Form MO W-3 along with the Form W-2 to the State of Missouri even if there is no state withholding.

Form MO W-3: Missouri Department of Revenue Transmittal of Tax Statements

Form MO W-3 is filed by businesses in Missouri to report the State taxable wages & taxes withheld during the tax year.

Note:Do not send any payment along with this form. If you have any withholding taxes due, you must use Form MO-941 to report them.

Learn more about Form W-2 Missouri State FilingsForm 1099 for the State of Missouri

There are several types of 1099 tax forms (1099-MISC, INT, DIV, R, S, B, & even more) which are used by payers to report the amount they paid to the individuals other than employees during the tax year and what kind of payment it is.

Required 1099 Forms for the State of Missouri

- Form 1099-MISC: This variant of Form 1099 used to report miscellaneous income paid to independent contractors.

- Form 1099-INT: Used to report interest payments made during the tax year.

- Form 1099-DIV: A tax statement provided by financial institutions to report dividends and other distributions.

- Form 1099-R: Used for reporting various distributions related to retirement benefits, including annuities, pensions, IRAs, profit-sharing, retirement plans, and insurance contracts.

Note: You must ONLY file the 1099 forms if there is state tax withholding.

The State of Missouri also requires the filing of Transmittal of Tax Statements Form MO W-3, along with the 1099 forms.

The state of Missouri participates in the CF/SF program,with this program,the 1099 Forms filed with the IRS will be automatically forward to the participating States.Therefore Missouri State doesn’t require you to file directly to them.

Form W2/1099 Tax Filing Deadline for the 2022 Tax Year for the State of Missouri

Remember to file your W2/1099 forms before deadline to avoid penalties for late filing. Its easy to file your forms and they can be completed in minutes with our software.

Information Required to File W2/1099 for the State of Missouri

In order to complete W2/1099 state filings for Missouri you need to provide the following information:

Business and Employee/Recipient Details

- Employer/Payer Information: Name, EIN/SSN, and Address

- Employee/Recipient Information: Name, EIN/SSN, and Address

Tax Withholding Details

- Federal Details: Wage Income, Miscellaneous Income and Federal Tax Withholdings

- Missouri State Filing Information: Missouri State Income, State Employer/Payer Number, and state Tax Withholdings

Make sure that you have all the required information to meet your filing requirements for the state of Missouri.

Haven’t filed your returns? Its free & easy to get started with our software! Start E-filing Now

Start Filing Now & Stay Compliant with Missouri State

Missouritaxfilings.info - A Cloud Based e-filing Software

Missouritaxfilings.info is one of the IRS Authorized e-file provider,offering provides simple e-filing solution for Business Owners, tax professionals, and Individuals. We offer exclusive features which make the entire filing process hassle-free. We use advanced technologies for ensuring security while your returns are transmitted to the IRS safe and secure. Our direct, user-friendly e-filing process will guide you throughout the filing process with the step-by-step instructions.

With our e-filing software, you can also e-file other federal employment tax Forms such as 941, 940, 944, 940/941 Schedule R, 1095-B and 1095-C. Click here to learn more about our supporting Forms and its features.

File your tax returns hassle-free with these key features

- Bulk Upload Employee/Recipient Details.

- Choose to Print & Postal Mail W2/1099 Copies.

- File multiple forms at once.

- Access your Form Copies Anytime.

- Transmittal Forms are generated automatically.

- Access copies at any time, from anywhere.

If you need any assistance, we are standing-by to help. Simply contact our US-based, dedicated support team with any questions you may have. We offer live chat, phone support (704.684.4751), and 24/7 email support (support@TaxBandits.com).

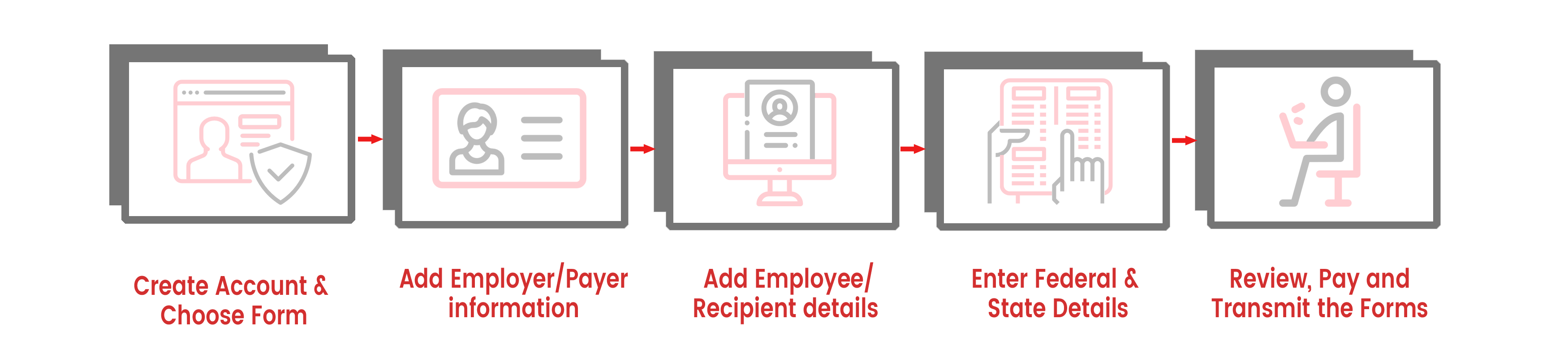

Steps to E-file W2/1099 forms for the State of Missouri

It's simple to efile W2 & 1099 for the State of Missouri. Begin by creating a free account and choossing the respective Form that you are required to file.

You are not required to download or purchase any software. With our cloud-based software, all you have to do is follow these easy steps to e-file your W-2 & 1099 returns online.

Missouri Paystub Generator

Generate Paystubs for employees and contractors. Whether you're in Kansas City, St. Louis, Springfield or anywhere in Missouri, our Missouri paystub generator will automatically calculate the taxes accurately.

Get Your First Paystub for Free

Generate paystubs conveniently from your mobile using our Paystub generator app.